Log-in here if you’re already a subscriber Release DateFebruary 1, 2023Supply chain fragility drives fourth 737 Max line decisionPurchase a...

Log-in here if you’re already a subscriber Release DateDecember 13, 2022With hundreds ordered, United wonders when its new fleet will...

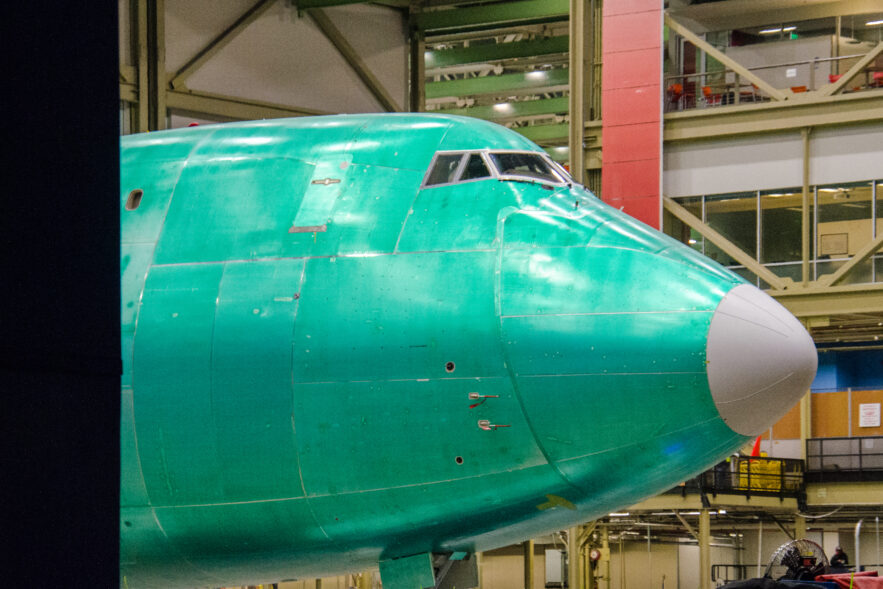

EVERETT — It was the one-thousand five-hundredth and seventy-fourth — and final — time a 747 left Boeing’s Everett, Washington...

Log-in here if you’re already a subscriber Release DateAugust 10, 2022Boeing resumes 787 deliveries, but another lull loomsPurchase a PDF...

Log-in here if you’re already a subscriber Release DateApril 1, 2022Boeing slows way down on Chinese 737 Max productionPurchase a...

The industry is closely watching Boeing’s progress as a bellwether for its own health and that of the disrupted global supply chain. While its build rate will accelerate to 31 early next year, the company will need to advance its delivery rate well over that level in order to burn down its enormous inventory of 737 Max aircraft built and stored during the grounding.

While Boeing announced it would slow the rate at which it builds 787s in mid-July below five per month, some suppliers have halted work and deliveries of large structural sections by at least one major supplier won’t restart until at least October 26.

Dogged by languid demand for twin-aisle aircraft and a spate of inspections, rework and manufacturing quality issues on already-built 787s, a question of the program’s long-term profitability hangs over Boeing. In its decade of deliveries, Boeing has earned back about half of the more than $28 billion in 787 production costs it has consistently reassured Wall Street it will recover.

Even as Boeing works to explain its detailed statistical analysis to the Federal Aviation Administration of its inspection findings on its fleet of undelivered 787 Dreamliners, the company continues to disclose new issues with its aircraft that further disrupt its path toward resetting its production system and restarting deliveries.

“Boeing is very much relying upon that commercial pressure from the airlines in China, putting political pressure on Beijing...And so far it hasn’t happened yet,” said Air Lease CEO John Plueger.

Airbus and Boeing, back in their corners, fight in the digital factory. Airbus in Hamburg is gearing up for production of the A321XLR.

The Federal Aviation Administration on Monday granted its first post-grounding airworthiness certificate to a 737 Max, clearing the way for Boeing to resume deliveries, the U.S. aviation regulator confirmed.