When Embraer spinoff Eve on Dec. 21 confirmed plans to combine with Zanite Acquisition Corp., it became the sixth company in the urban air mobility space to link up with a special purpose acquisition company (SPAC). Rather than speak to the continued strength of SPACs, however, the deal illustrates the funding vehicle’s decline as an ample source of outside capital — even as it cements Embraer’s strategy of using partnerships to expand into new markets.

These findings imply that the first wave of eVTOL developers should focus less on pitching their services as a daily commuting solution, and more on a mix of use cases that can support a practical and profitable roll-out. There’s a chicken-and-egg element involved in scaling UAM: driving costs low enough to create the demand that will drive costs down even further. While there are additional hurdles to scale (such as coordinating thousands of low-altitude flights per day in congested urban airspace) economics will be front and center in establishing this new industry’s viability, and the evidence suggests that if you build a system for commuters alone, they won’t come.

Elan Head and Jon Ostrower·

For Wisk and its major backers, it’s all or nothing — and if the startup can win a fully-autonomous certification, it offers Boeing a bridge to adapt those technologies to its next-generation airliners, a goal it has eyed since at least 2017.

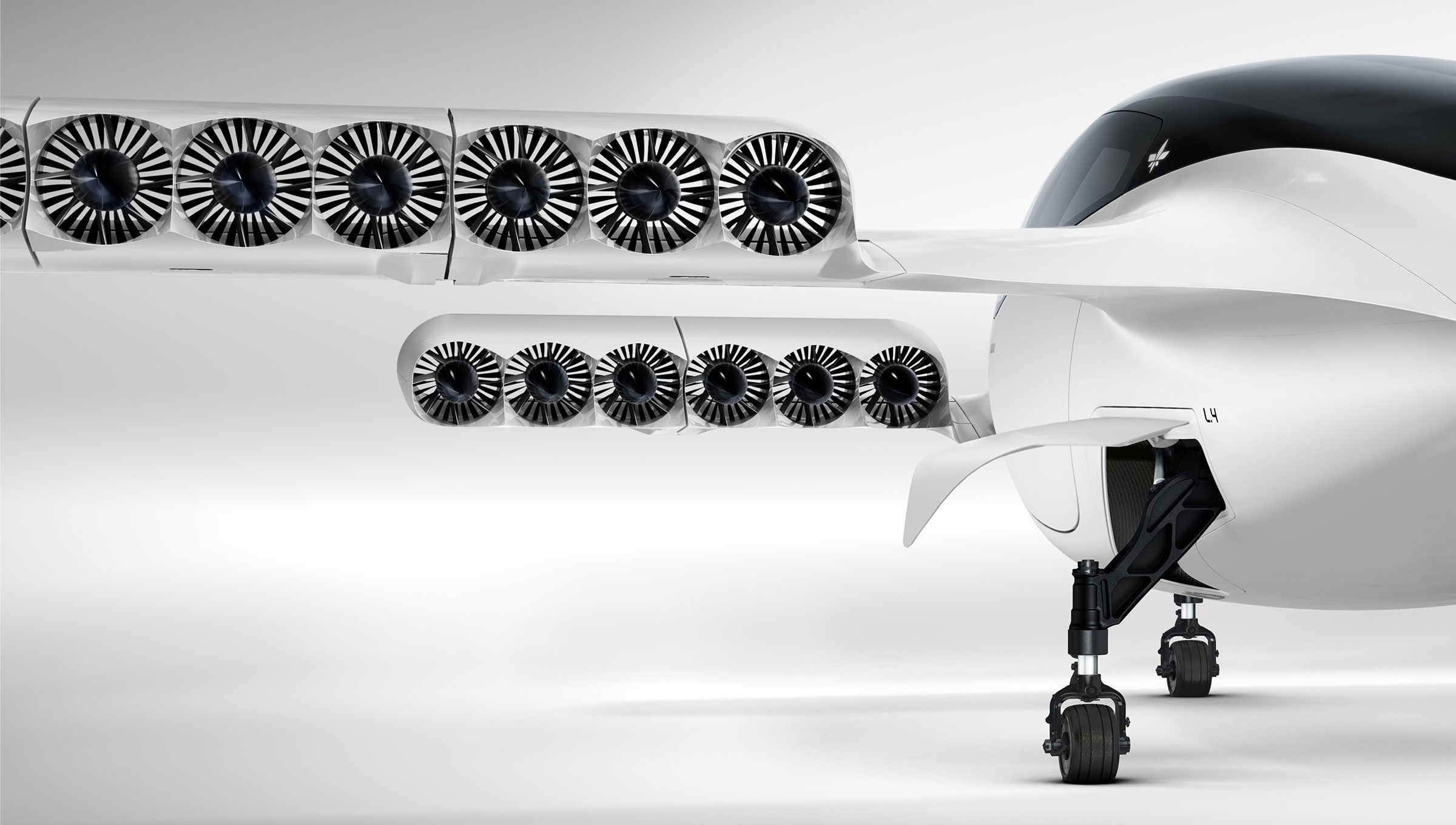

NetJets and FlightSafety International – both units of Warren Buffett’s Berkshire Hathaway – have jumped into the electric vertical take-off and landing market, announcing plans for a strategic partnership with the German eVTOL developer Lilium. Buffett’s aviation investments have been stretched across the aerospace chain and with varying success.

Chorus Aviation is acquiring Falko Regional Aircraft, kicking off a fresh round of consolidation in the leasing space -- this time among those who focus on regional aviation.

The Federal Aviation Administration and U.K. Civil Aviation Authority have started working toward a bilateral agreement for the future certification and validation of eVTOL aircraft. It’s a post-Brexit signal that the CAA is not looking exclusively to Europe for guidance.

While such deals across the rising eVTOL industry seemingly represent a new aerospace business model in which customers have a stake in the overall success of the product, a detailed review of securities filings and other fine print by The Air Current reveals a far more transactional arrangement. Airlines are lending their branding and credibility in exchange for a possibly lucrative piece of a buzzy market, regardless of whether or not an aircraft will be delivered or even formally ordered.

Sign up to receive updates on our latest scoops, insight and analysis on the business of flying. Electric vertical take-off...

Log-in here if you’re already a subscriber This post appeared as part of our Three Points Newsletter on October...

Log-in here if you’re already a subscriber How much juice do the key eVTOL entrants have left in their tanks?...

Jon Ostrower and Elan Head·

Boeing rolls-out final 747 EVERETT — It was the one-thousand five-hundredth and seventy-fourth — and final — time a 747...

Log-in here if you’re already a subscriber Release DateDecember 15, 2022Electric aircraft unknowns spur new approaches to leasingPurchase a PDF...

Log-in here if you’re already a subscriber Release DateApril 10, 2023The ballpark price for certifying an eVTOL is going upPurchase...

Jon Ostrower and Elan Head·

Log-in here if you’re already a subscriber Release DateMay 31, 2023Boeing takes Wisk fully under its wingPurchase a PDF of...