Log-in here if you’re already a subscriber

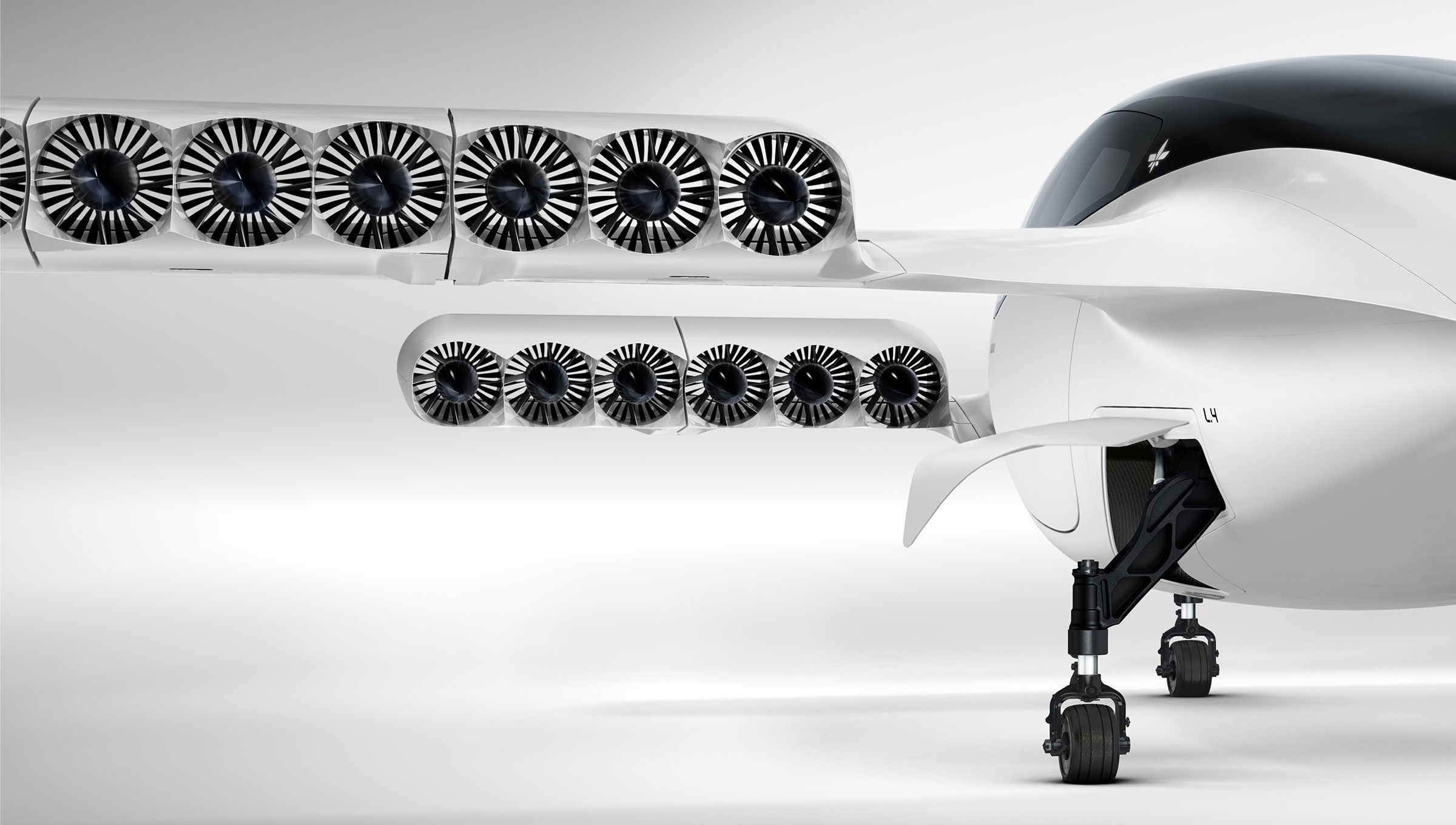

On March 14, the short seller Iceberg Research published a damning report on Lilium, calling the German developer of electric vertical take-off and landing aircraft “the losing horse in the eVTOL race.” The report, intended to tank the company’s stock for Iceberg’s benefit, cast doubt on Lilium’s aircraft design and battery technology, and drew attention to its dwindling cash reserves, which are projected to last just 18 months at current burn rates.

Iceberg also called out the company’s airline partner, Azul Brazilian Airlines, which in August last year announced the intent to purchase 220 Lilium aircraft for $1 billion to launch an eVTOL network in Brazil. At the time, Lilium was in the process of going public through a merger with the special purpose acquisition company (SPAC) Qell Acquisition Corp. In consideration of their “strategic partnership” — which does not yet include a binding order — Lilium gave Azul warrants to purchase 1.8 million of its shares at the discounted price of €0.12 a share. Azul will receive warrants for another 6.2 million shares should the companies enter into “definitive agreements.”

Related: Embraer SPAC deal reflects changed funding landscape for eVTOL developers

While such deals across the rising eVTOL industry seemingly represent a new aerospace business model in which customers have a stake in the overall success of the product, a detailed review of securities filings and other fine print by The Air Current reveals a far more transactional arrangement. Airlines are lending their branding and credibility in exchange for a possibly lucrative piece of a buzzy market, regardless of whether or not an aircraft will be delivered or even formally ordered.

As Iceberg characterized it, “Lilium, more likely than not, offered its shares as payment for the right to market an established company as a partner.” Yet, Lilium is hardly alone in this strategy. Multiple eVTOL developers that have gone or are in the process of going public via SPAC have struck “partnership” agreements with airlines and lessors that involve significant stock incentives. If Iceberg is correct that “such ‘marketing agreements’ rarely translate to real business,” then the eye-popping pre-orders airlines have placed for electric air taxis may have little bearing on their actual demand for the same.

Subscribe to continue reading...Subscribe to Continue Reading

Our award-winning aerospace reporting combines the highest standards of journalism with the level of technical detail and rigor expected by a sophisticated industry audience.

- Exclusive reporting and analysis on the strategy and technology of flying

- Full access to our archive of industry intelligence

- We respect your time; everything we publish earns your attention