With this evaluation for its turboprop concept, Embraer is scratching at an entirely new strategic consideration for a multi-decade aircraft program. While large aircraft design has relied on the same fundamental type of fuel, coupled with successive generations of ever-improving engines, Embraer views its new 90-seater airframe as propulsion agnostic and a halfway step toward hydrogen. Positioning the engines on the rear of the aircraft might not produce the single most optimized design in 2027, but, in Embraer’s view, that deliberate non-optimization allows room for future evolution and growth.

Fundamentally, even with this new shape, Embraer’s tentatively designated TPNG 70 and TPNG 90 (Turboprop Next Generation) haven’t changed in their overall mission. The aircraft is still a 70 to 90-seat turboprop with a range “a little bit more than 800 nautical miles” but optimized for flights between 250 and 300 nautical miles and flown at speeds “faster than an ATR, but not as fast as the Dash 8-400,” said Souza, putting its cruising speed between 300 and 360 knots. Embraer’s goal is a 15% to 20% improvement in cash operating costs for its bigger TPNG 90 compared to the ATR 72-600.

Afghanistan is lost. Beyond the crushing enormity of the human tragedy unfolding there, the jarring images from Kabul Airport capture not only the desperation to escape the Taliban, but the very essence of what aviation represents as a path to the future. Embraer heavily revised its turboprop concept and with it the company is shifting its focus from Asia squarely to North America. Qatar Airways has pulled 13 A350s from service on the order of its home regulator, but what's paint issue facing the aircraft?

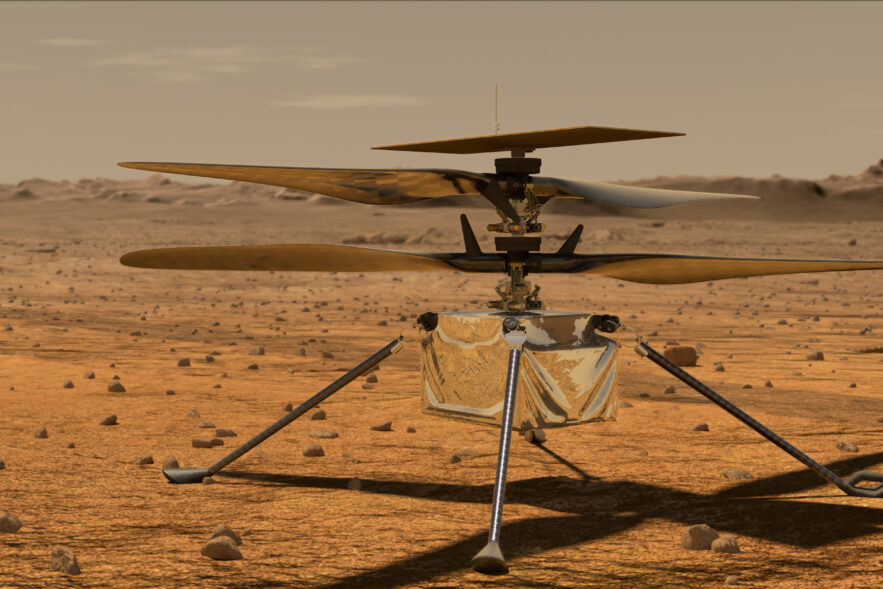

De Havilland Canada's time building the Dash 8-400 turboprop in Downsview is coming to an end as the company plans to indefinitely pause production, but is leaving the door wide open to start again to begin a new for a post-COVID-19 rebound in demand. The fourth rock from the sun is slated to become the solar system's second planet to host a powered flight. Perseverance and Ingenuity arrive on Mars on February 18. As single-aisle jets like the Airbus A321XLR take on roles once assigned for long-range twins, the more narrow cabin is going to be a battleground for increasingly complex passenger systems in the fight against commodification.

The nuances of regional markets, both emerging and established, will offer a path for Embraer's E3, but will also limit its possible success. Turboprop customers are particularly sensitive to aircraft pricing, which will be challenged by the scope and pricing of a new development. By reintegrating its commercial unit, Embraer’s engineering talent is unconstrained to operate across its executive jet, defense and eVTOL businesses.

In an extended interview, Arjan Meijer, Embraer's new Commercial Aviation CEO sat down with The Air Current to discuss what it wants in a partner and its path to a new turboprop.

With receding regional aviation competitors, Embraer studies a return to a market that hasn’t had the choice of an all-new product in decades. Unique quirks of the turboprop market and Embraer technology planning will pressure E3 market potential. Big leaps in efficiency of single-aisle jets compresses the list of small markets that need a big turboprop.

To E3 or not to E3 Embraer’s commercial aircraft boss, John Slattery, put to bed on Monday the prospect of launching a...