Log-in here if you’re already a subscriber

The $19 billion being used to rebuild New York’s John F. Kennedy International Airport (JFK) has the potential to dramatically reshape how the redevelopment of all airports in the United States is paid for, but only if the project’s sponsors can prove that its private equity investment model has broader appeal.

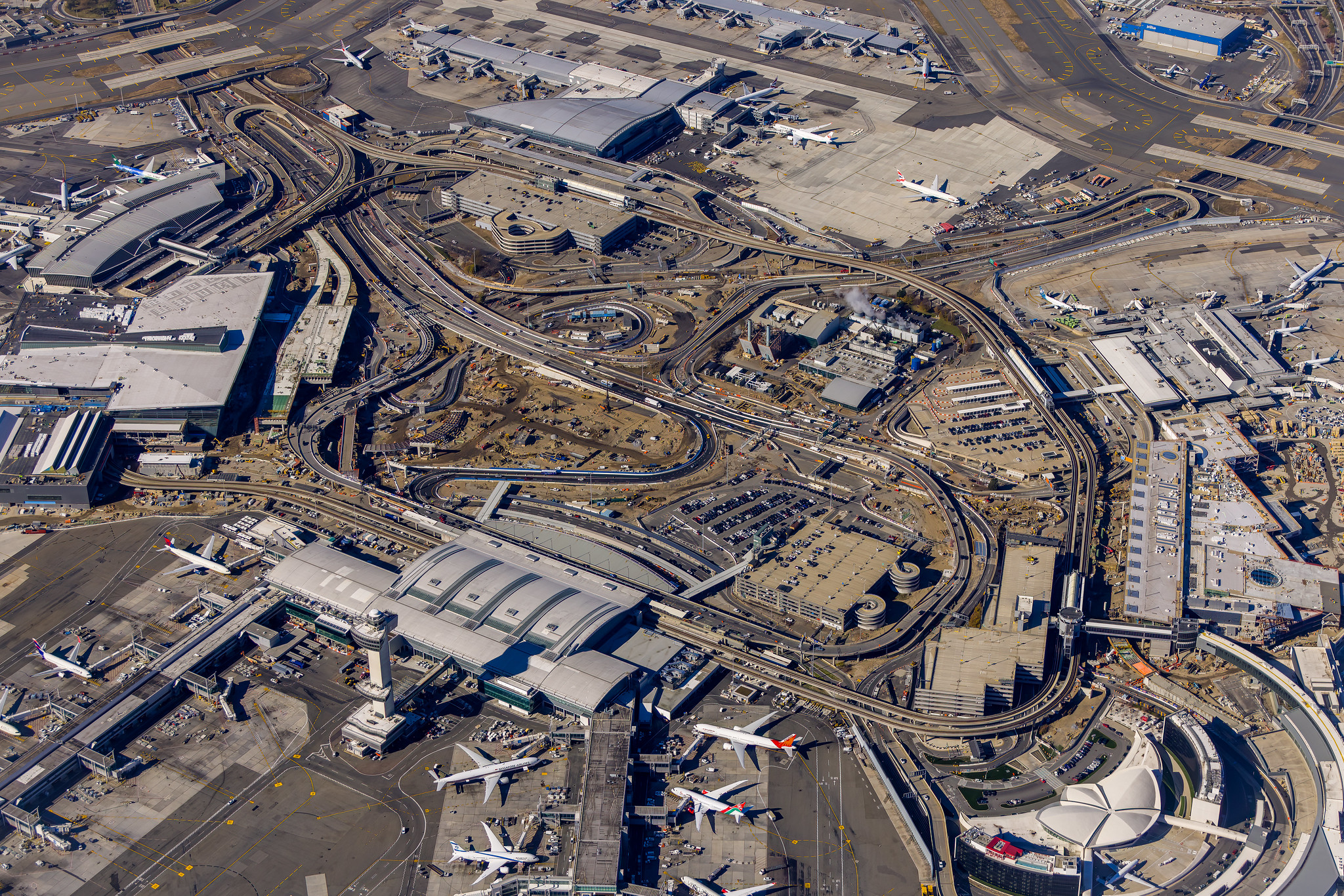

JFK’s complex redevelopment plans cover four of its five terminals, underpinned by a $3.9 billion injection of funding from the Port Authority of New York and New Jersey to upgrade the roadways and power infrastructure common to the entire airport. That public money, when coupled with over $15 billion of private investment, constitutes a public-private partnership (PPP). PPPs are used to combine a mix of public and private funding to complete a project or provide a service that is traditionally delivered exclusively by the public sector.

While PPPs have been used throughout the U.S. to accelerate the timelines of large transportation projects or fill public funding gaps, they have been less popular at domestic airports due to airports’ heavily regulated, publicly-backed financing structure. U.S. airports have traditionally relied on federal grants and Congressionally-regulated passenger fees to finance their operations — levers that airport groups say won’t be enough to keep up with what they see as rapidly growing infrastructure needs.

Project leaders and investors at JFK argue that the scale of its redevelopment could change the airport industry’s appetite for relying on the private sector to develop and manage airports given that the project represents the single largest PPP in U.S. history. That practice of partial or even full privatization is used heavily by the rest of the world’s airports. Gleaming terminals in Istanbul, Singapore and Dubai have all benefited from private investment through PPPs or sovereign wealth funds. (The U.S. does not currently have a sovereign wealth fund, although President Donald Trump recently outlined a plan to create one.)

Yet the U.S. is not the rest of the world, and JFK is not representative of the average U.S. airport.

Subscribe to continue reading...Subscribe to Continue Reading

Our award-winning aerospace reporting combines the highest standards of journalism with the level of technical detail and rigor expected by a sophisticated industry audience.

- Exclusive reporting and analysis on the strategy and technology of flying

- Full access to our archive of industry intelligence

- We respect your time; everything we publish earns your attention