Log-in here if you’re already a subscriber

When the California-based electric vertical take-off and landing developer Joby Aviation announced plans to combine with the special purpose acquisition company (SPAC) Reinvent Technology Partners in February 2021, it laid out a clear vision and roadmap for prospective investors. With more than a decade of research and development work already under its belt, Joby aimed to obtain Federal Aviation Administration certification for its eVTOL aircraft and launch its own air taxi service in the United States by 2024. The company planned to operate in two to three U.S. cities through 2025, building and proving out its business model. After that, it anticipated expansion into additional markets, including overseas, with the expectation that international civil aviation authorities would validate its FAA type certificate pursuant to existing bilateral agreements.

This strategy was reiterated in countless media interviews and investor presentations, becoming part of the core narrative around the emerging urban air mobility industry. What was less widely known (in part because the company carefully avoided discussing it with reporters) was that Joby and Reinvent had backup plans in case FAA certification or the launch of air taxi service did not go as planned. Buried in a 112-page investment memo from July 2021 is a discussion of Joby’s “downside cases” and how the company could potentially pivot, including by pursuing defense opportunities, selling aircraft instead of or in addition to operating its own fleet, and launching internationally instead of in the U.S. “While Joby doesn’t intend to launch internationally, there are many attractive markets,” the memo states, highlighting “centralized government decision making” in the Middle East and demand in megacities in Asia.

Related: Archer plays the hare to Joby’s tortoise in eVTOL race

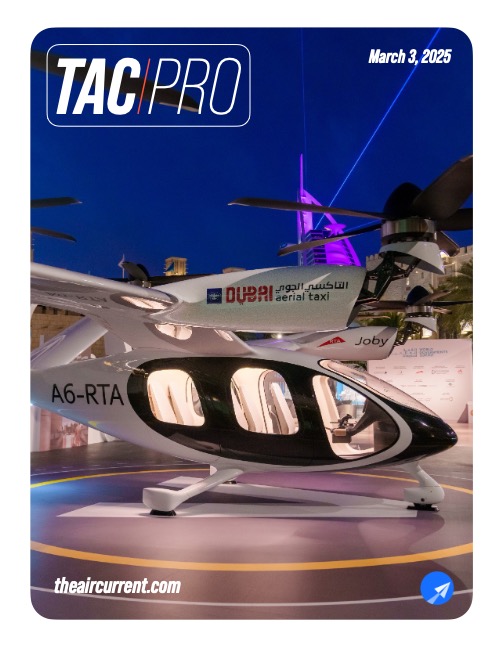

With the release last week of 2024 financial results by Joby and its chief rival, Archer Aviation — both of which maintain strong balance sheets four years after announcing their SPAC mergers to list on the New York Stock Exchange — it is evident that Plan B is now the plan. Apparently resigned to the fact that FAA type certification could still be years away, both companies are talking up defense opportunities and exploring new models for aircraft sales. Perhaps most significantly, they are increasingly shifting their focus to the United Arab Emirates, which is encouraging them to work toward early operations in the country as part of the nation’s bid to lead the world in advanced air mobility — a radical disruption of the established aircraft type certification process.

“I think that we always knew that the global market for this sort of solution would be exactly that, global,” Paul Sciarra, Joby’s executive chairman, told The Air Current in an interview, recalling the company’s strategizing in 2021. “I think the question about which markets would be most interesting when was probably still at that point quite uncertain, and I think we’ve gotten some interesting new information on that front. You know, you have certain markets in the Middle East that are definitely willing to move heaven and earth to be first to market with this technology, and we’re obviously happy to support that effort.”

Subscribe to continue reading...Subscribe to Continue Reading

Our award-winning aerospace reporting combines the highest standards of journalism with the level of technical detail and rigor expected by a sophisticated industry audience.

- Exclusive reporting and analysis on the strategy and technology of flying

- Full access to our archive of industry intelligence

- We respect your time; everything we publish earns your attention